The Meeting That Sparked a Question

Last week’s Trump–Putin sit-down was heavy on political theater but light on details. While headlines focused on diplomacy, it raised an intriguing question for the beverage world:

What does this renewed spotlight on U.S.–Russia relations mean for one of Russia’s most iconic exports — vodka?

And more importantly: what does it mean for American shelves, bars, and consumers?

From Moscow to Miami: The Flow of Vodka

Before the Ukraine war, Russia supplied over $18 million in vodka imports annually to the U.S.

By 2022, after sanctions and the war, that number dropped to less than $6 million.

U.S. distributors pivoted quickly, with brands like Polish Belvedere, Swedish Absolut, and U.S.-made Tito’s filling the gap.

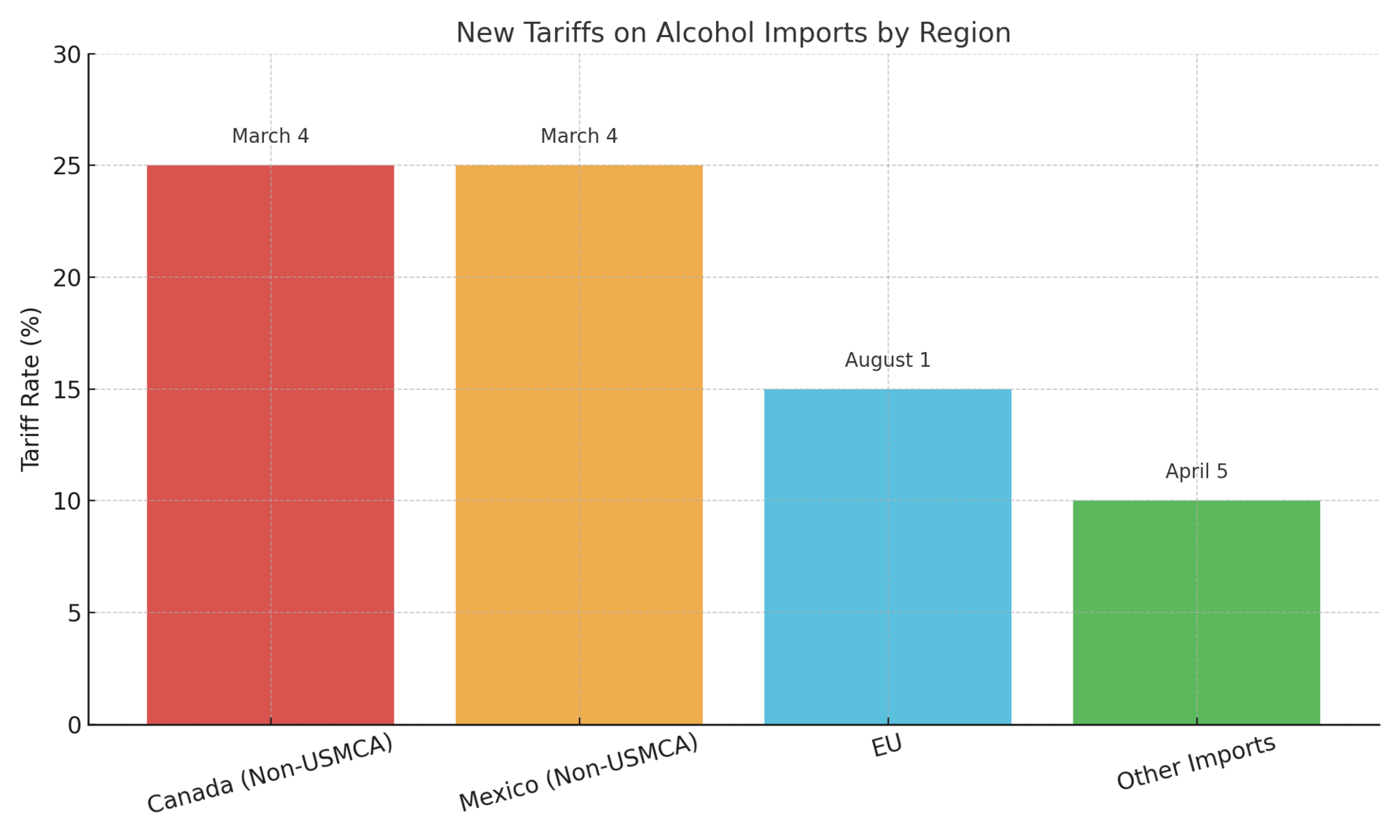

Tariffs and Red Tape

Trump’s first presidency saw tariff battles with Europe and China, and insiders expect that a return to office could bring back protectionist policies. If tariffs extend to European spirits, the shift could ironically benefit U.S.-made vodka while squeezing imports further.

Imports from Russia collapsed after 2022; Poland, Sweden, and U.S. production filled the void.

Vodka’s Cold War Redux

Since Russia’s invasion of Ukraine in 2022, the U.S. has steadily tightened restrictions on Russian imports, including spirits. Add in Trump-era tariffs and renewed talk of trade penalties, and what used to be a global staple—Russian vodka—has nearly vanished from U.S. shelves.

In 2021, before the war, Russian vodka accounted for 1.3% of total U.S. vodka imports (Distilled Spirits Council of the United States). Today, that share is nearly negligible. Distributors, retailers, and consumers have pivoted quickly to alternatives, with brands from Poland, Sweden, and the U.S. itself taking up the shelf space once reserved for “Mother Russia.”

Winners in the Shift

Polish Vodka (Belvedere, Sobieski) – Riding a wave of “authenticity” marketing, Poland has leaned into heritage and production methods to fill the gap.

Swedish Vodka (Absolut) – Already a global powerhouse, Absolut has positioned itself as a premium, politically “neutral” alternative.

American Craft Vodka – Smaller distilleries across states like Texas, Colorado, and Oregon are capitalizing on the “drink local” movement, boosted by a sense of patriotic consumer choice.

Behind the Bar

The vodka story is no longer just about Russia. It’s about how politics shapes palates:

Consumers are trading “cheap shots” for premium bottles.

Bars are leaning on American craft vodkas to sidestep supply headaches.

Tariffs could quietly reshape cocktail menus, pushing more “Made in USA” options.

The Bigger Picture

The vodka category in the U.S. isn’t shrinking—it’s evolving. Consumers still drink vodka at high volume, but where it comes from, how it’s marketed, and what it represents are shifting dramatically. The war in Ukraine and the echoes of Trump-era tariff battles have turned a once-straightforward commodity into a story of geopolitics, patriotism, and preference.

Bottom Line

The Trump–Putin meeting may be about global strategy, but for the beverage industry, it’s a reminder: politics pours straight into the glass. What consumers choose at the bar or liquor store today is as much about values and politics as it is about taste and price.

👉 Pour Decision: Keep an eye on how politics filters into your glass. Today’s tariffs could be tomorrow’s cocktail trend.